I am writing this post on board Cathay Pacific 830 from HK to NY en route to Sao Paulo, following two weeks of off the record discussions with CEOs, institutions, and government officials in Asia.

(Quick side note, Marester, the Filippina cabin chief and her team, yet again sets a high benchmark for global customer service. Cathay easily has the most in-depth data and understanding of its clients to make them feel welcome and personally attended to – they actually make me look forward to flying despite fifteen years of constant global travel. Chapeau bas and good luck to the competition).

While many people in Asia focused more on the US elections than the leadership transition in China, the conclusion of the 18th Party Congress, its leadership transition, and the 12th five year plan have profound implications for the world overall and global investment management in particular.

The new leadership in China:

There are high expectations for Xi Jinping as he takes over as both general secretary of the Central Committee of the CPC and chairman of the central military commission (there was much speculation about whether Hu Jintao would continue as CMC head similar to Jiang Zemin), giving him a strong mandate of change for the country.

The other six members of the Standing Committee of the Political Bureau, elected at the first plenum following the 18th National Congress, are:

– Li Keqiang

– Zhang Dejiang

– Yu Zhengsheng

– Liu Yunshan

– Wang Qishan – secretary of the Central Commission for Discipline Inspection.

– Zhang Gaoli

Notably, both Xi and Li were born after the founding of the PRC in ’49. Xi in his official address juxtaposed “world-renowned achievements” and “every reason to take pride” with “many pressing problems within the Party … , particularly corruption, taking bribes, being divorced from the people, going through formalities and bureaucracy caused by some” to “ensure that our Party will remain at the core of leadership in advancing the cause of socialism with Chinese characteristics.”

Investing in China

Jim O’Neill sees China slowing down from 10% real GDP growth to 7% with a focus from quantity of growth to quality of grow, but still the best BRIC investment. A big part of that quality will be the shift from an export led to a consumer led economy centered around domestic consumption.

For many, capital market, currency and banking reforms are at the core of China’s challenges, overall tied to larger social issues around the quality of life.

As an example, non performing loans (NPL) among Chinese banks have increased for four consecutive quarters, the most pronounced decline in asset quality in almost a decade. The CBRC this month reported RMB 22 billion in Q3/2012, to RMB 480 billion. Overall, CBRC chair Shang Fulin reported at the 18th party congress that the NPL to total loans with 1% stands at a low level.

On the other hand, state-owned enterprises have increasingly been going global. Overseas investments through August have reached $53 billion, already almost matching the full year total of $60 billion in 2011. The chair of the state-owned assets regulator, Wang Yong, at the congress spoke about the need to look for global business opportunities in a variety of industries. For instance, ICBC chairman Jiang Jianqing stated that his firm had earned almost $900 million from overseas operations in the first half of this year.

The prospects for QFII and RQFII as quotas increase

And CSRC chairman Guo Shuqing during the party congress stated that the commission will continue to enlarge the quota for foreign investors to stabilize the securities market and expand investments into China, partially by making application standards for foreign firms easier.

QFII, launched ten years ago to allow foreign brokerage, investment and trust houses to invest in China’s capital markets, especially via A shares. The CSRC increased the quota from $30 billion to $80 billion, but demand is higher still and Guo is looking to offer preferential tax policy in line with international standards for QFII.

In addition, the commission has agreed in principle to again increase the pilot RQFII (yuan QFII) program to satisfy demand. RQFII was launched last December to offer financing channels for international RMB funds to invest in the mainland securities market. The initial quota of RMB 20 billion was increased to RMB 70 billion in April, and the CSRC now in principle has ok’d a further dramatic increase to RMB 270 billion.

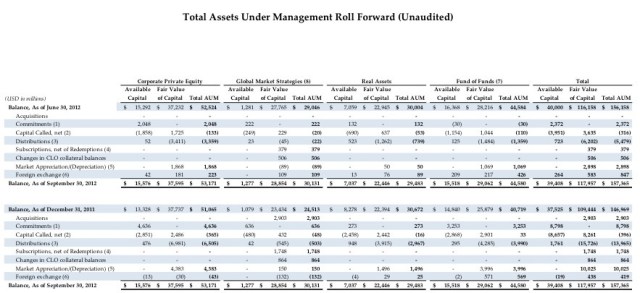

According to SAFE (the state administration of foreign exchange), at the end of the third quarter there were:

– 157 funds with almost $31billion in QFII

– 21 financial institutions with almost RMB 40 billion in RQFII

Guo during the party congress expressed his confidence in the mainland securities market, despite the last few turbulent months. Guo Jianwei, deputy director general of the PBC recently called on Chinese banks to follow a “going global strategy“.

An era of partnerships, increasingly with emerging market bridges.

In one of my books written for Strategic Insight, “Building Bridges”, I explored the growing trend for emerging fast growing regions such as Asia, Latin America and MENA to work together without going through Europe or the US.

The case studies in the book include for instance the 75% of offshore allocations by Chilean institutional investors to Asia-Pacific investment products, the $250 billion of Brazilian high yield fixed income products in Japan, over a third of Fidelity’s SE Asia flagship assets coming from Latin investors and the focus for Compass group on raising awareness for the Andean Three amongst Asian asset holders.

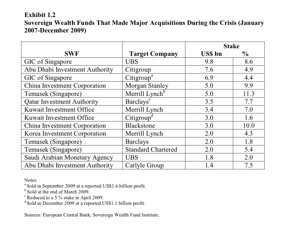

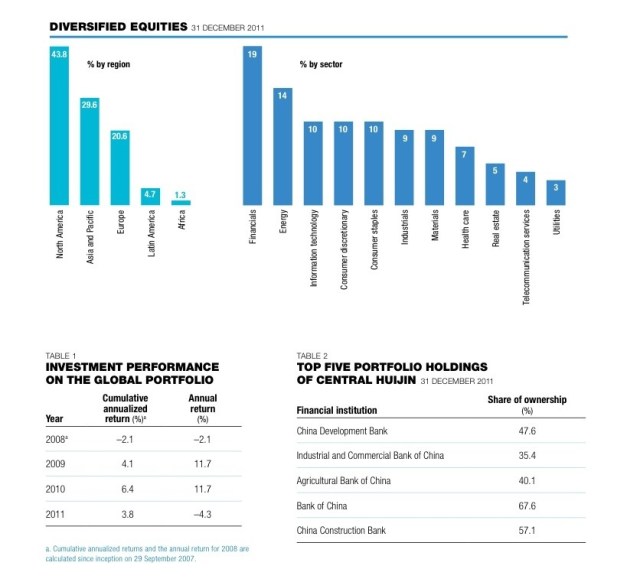

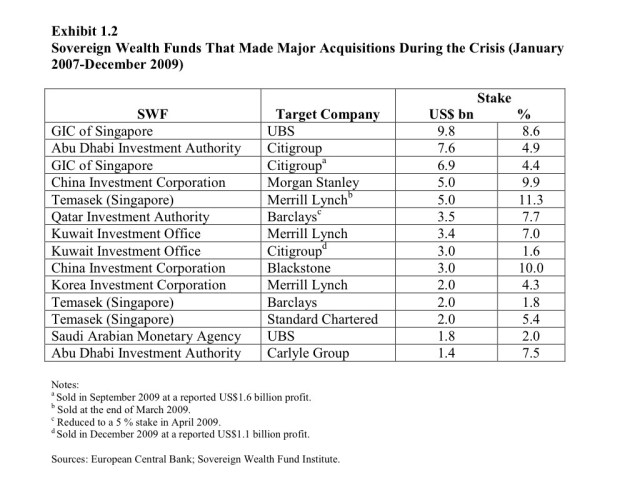

My recent review of sovereign wealth investing featured CIC’s direct investments in BTG Pactual in Brazil and Shanduka in Africa, as well as the new joint asset management venture between Qatar and Credit Suisse.

And if we look at global cash flow patters year to date with Strategic Insight data, Japan and China locally have raised inflows to equity vehicles, thematic in Japan and with innovative ETF structures in China.

Again, for China the theme of partnership is dominant – the top cash flow fund in Asia locally ytd is the JV between Huatai and PineBridge, with the CSI 300 ETF.

A few years back I had the pleasure of participating in a China/US discussion on competition and collaboration, with John Kerry talking about the US government’s views and me talking about global asset management to an audience of Chinese asset management CEOs and US institutional investors.

And today, the collaborative aspects and the strategic importance of China and Asia cannot be overstated. As I am flying back to NY, President Obama is on his way to the East Asia Summit of the ASEAN, following Hillary Clinton’s recent Foreign Policy position paper and her view that the 21st century will be “written in Asia”.

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2012

You must be logged in to post a comment.