One of the central themes in my latest book, State of the Asset Management Industry – Latin America, is around greater and more direct links between fast-growth emerging economies and regions, especially Asia and Latin America.

More specifically Brazil as a leader in LatAm, and China in Asia, and their growing strategic importance. Or, as FedEx with the help of Sir JJ Institute of Applied Art depicted it, “within walking distance”.

China - Brazil "Within Walking Distance" - FedEx/Sir JJ Institute of Applied Art

Brazil is the hotspot right now, and doesn’t come cheap, but that hasn’t stopped money managers to hit the ground running. As shown below, just for January 2012 the fund industry in Brazil added $11 billion in net cash flows.

| Brazil – Net Flows & AUM by Asset Class |

| In USD Billion |

|

|

Net Flows |

AUM |

|

|

Jan-12 |

12/11 |

| Fixed Income |

|

6.2 |

490 |

| Mixed Multimercado |

|

0.5 |

231 |

| Equity |

|

-0.6 |

108 |

| Other |

|

1.5 |

96 |

| Total Long-Term |

|

7.7 |

925 |

| Money Market |

|

2.4 |

45 |

| Total Above |

|

10.1 |

970 |

| Memo: |

|

|

|

| Private Pension |

|

0.8 |

134 |

| Total Industry |

|

10.9 |

1,105 |

|

|

|

|

| Source: Strategic Insight, ANBIMA |

|

|

|

A few of the more recent deals and developments:

– CCB in acquisition talks with three banks in Brazil: As the WSJ reported in January 2012, China Construction Bank is in talks with two to three banks in Brazil with an acquisition that might cost CCB around $600 million (estimates range from $200 million for the smallest bank to around $500-$600 million for the other two, each, according to Dow Jones).

Last August Industrial & Commercial Bank of China (ICBC) bought 80% of Standard Bank Group’s operations in Argentina in a similar $600 million deal (As the WSJ reported, the deal came after the central bank in Brazil said that ICBC submitted an application to begin operations in Brazil).

– BTG Pactual buys rival Celfin Capital in Chile to build out the region: Led by the by now legendary Andre Esteves (who became a billionaire after the UBS Pactual deal) and Persio Arida (former president of the Brazil Central Bank), BTG in February 2012 acquired Celfin Capital in Chile, to move into the lucrative pension fund markets of Chile, Peru and Colombia, and to overall build out their Latin America presence. The group combined now manages $70 billion in asset management AUM and $30 billion in wealth management assets, for a total of $100 billion. Esteves is talking about the “flow of business between the regional markets growing strongly” and his goal to be the “regional reference point”, most certainly with ambitions to move into other global regions soon.

Andre Esteves - BTG Pactual

– Principal Group takes indirect ownership of Claritas in addition to JV: Principal Financial Group, a leading retirement fund manager in the US, in March 2012 bought a 60% indirect ownership of Claritas Investments as part of some $900 million in capital investments for the year. Claritas manages close to $2 billion in assets in Brazil. and gives Principal a new door into the local market and the region. Since the late 1990s Principal has had a joint venture with Banco do Brasil, distributing pension and VA products through Brasilprev.

Luis Valdes, President Principal International

Luis Valdes, Principal International President & CEO, emphasized the strategic importance for the firm to enter the Brazilian fund industry. Conversely, Carlos Ambrósio, managing partner at Claritas, is looking to Principal’s global investment expertise to expand capabilities and distribution.

Larry Zimpleman, Chairman, President & CEO, Principal Group

Principal Chairman & CEO Larry Zimpleman sees Brasilprev and Claritas as targeting different market segments, but “both support our goal to be a pension and long-term investment leader in Brazil.”

– Julius Baer buys stake in Global Portfolio Strategists (GPS) to go after Brazilian and LatAM (U)HNW investors: Swiss private bank Julius Baer in the spring/summer 2011 acquired a 30% stake in Brazilian wealth manager GPS (GPS Planejamento Financeiro and Administração de Recursos) to build out wealth management in Latin America. GPS has a staff of around 85, run by nine partners and three founding partners (José Eduardo Martins, Marco Belda and Roberto Rudge) – the deal gets JB two seats on GPS’ board.

– Credit Suisse & Hedging Griffo: After acquiring investment bank Garantia in 1998, Credit Suisse bought a majority stake in Hedging Griffo in 2006 and then acquired full control in 2011, to build out an onshore asset management and private banking business. HG is run by 70 partners, but most of the attention for the firm has gone to Luis Stuhlberger, the manager of the flagship Verde hedge fund and its offshore version, the Green fund. Stuhlberger implemented Hedging Griffo’s asset management business in 1992. HG’s multi-mercado business contributed strongly to the profitability for CS in 2011, making Brazil a key contributor for the group (and full control a costly undertaking).

Luis Stuhlberger, CIO Hedging Griffo

Thus, away from the strategic long-term opportunities for the region’s institutional and HNW markets, we are now seeing more and more tactical opportunities for asset managers around concrete profitability projections.

And the opportunities go beyond asset management.

– Blackstone buys 40% of Patria to do more deals: The Blackstone Group in the fall of 2010 announced a partnership with Pátria, a private equity pioneer in Brazil, along with the purchase of a 40% stake. Both firms agreed to cooperate on building their businesses in Brazil and throughout Latin America.

Stephen Schwarzman, Chairman/CEO Blackstone

Blackstone Chairman and CEO Stephen Schwarzman commented on their long history together. Partnering with Pátria enables Blackstone’s limited partners and advisory clients to benefit from the fast expanding business opportunities in Brazil – and from Pátria’s deep knowledge of the local market. Focal points are financial advisory services, real estate, private equity, capital management and infrastructure.

Pátria CEO Luiz Otavio Magalhães sees the deal as one of the most significant partnerships in Brazil’s financial industry.

Luiz Otavio Magalhães, CEO Patria

Notably, the trend is not only for international fund managers to go into Brazil, but now also for Brazilian managers to go abroad.

– Brazil’s Safra buying Swiss Sarasin as a hub for Europe, Asia and the Middle East: Emerging market managers are buying stakes or acquiring developed market players. As the private banking industry in Switzerland has hit some bumps in the road and is likely to see consolidation, industry observers assumed that Julius Baer would be the buyer for Sarasin, having made no secret of ambitions to grow via acquisitions. Baer previously bought ING’s Swiss operations, but was not able to add those of ABN Amro. In the case of Sarasin, management resisted the Baer takeover for a variety of personal and business reasons. Enter Brazil’s Safra Group.

Joseph Safra, Chairman Safra Group

Safra surprised the local industry in Switzerland by agreeing to buy a majority stake for Sarasin from Rabobank for $1.1 billion to expand and link private banking in Europe, the Middle East and Asia. Sao Paulo-based Safra, having moved its headquarters there from Syria in 1952, will bring some Samba to the Bahnhofstrasse. Chairman Joseph Safra stated “the origins of Safra and Sarasin are very similar”, with “philosophies and strategies to private banking that are very much the same.”

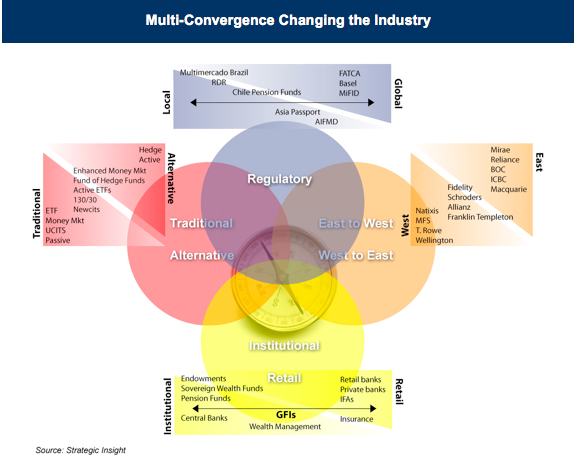

The industry should prepare for many more emerging market players to emerge as competitors and acquirers on the world stage of asset management, led by countries like China, Brazil, and the N-11. At a recent industry conference in Sao Paulo I interviewed the leaders of some of the top Brazil asset managers on their strategies.

Some firms make the jump… others are exploring. Investment banking, mutual funds, private banking, hedge funds, private equity, Brazil locally and as a hub for the region and beyond, Brazil is becoming both a tactical and strategic opportunity for market entry, regional expansion and global interconnectivity of an ever more complex asset management industry across clients segments.

Go hard or go home.

40.725787

-74.002928

![]()

You must be logged in to post a comment.