FUND FORUM ASIA INTERVIEW 2012 – BRAND VERSUS BOUTIQUE

Is There Space For Niche Players In A Brand-Conscious Market?

During the main conference of the Fund Forum Asia 2012 in Hong Kong, I had the pleasure of discussing brand in asset management with Alan Harden, a leader in the Asia asset management industry and CEO for BNY Mellon Investment Management in the region. Below are the main points of our talk.

DEFINING BRAND:

Enskat: Let’s approach the topic of brand top-down and define it first. Looking at the best 100 global brands worldwide, we see a few financial services firms represented, which is encouraging, especially compared to consumer brands.

For example, Apple now ranks as #8 globally and this morning announced almost $12 billion in quarterly profits (with revenue doubling in Asia). Google is #4. In comparison, JP Morgan and Citi rank at #28 and #32 respectively. Not bad.

Interbrand: Best Global Brands 2011 – Ranking of the Top 100 Brands

However, the flipside of that coin is Apple’s brand value grew by #58 year on year, while JPM and Citi stood at 1% and -3%, respectively.

How do we define asset management brands and how do they stack up?

Harden: Beyond language and name recognition, you have to make your brand well-known holistically, especially in the retail space. On the institutional side I would define brand around the quality of investment process and the information delivery experience. Those two combined equal a promise towards what a company can do and thus supports brand.

At BNY Mellon Investment Management, we have specialist brands and BNY Mellon as an umbrella. Having 16 boutique firms with their own distinct brand adds a certain degree of complexity to our business.

THE IMPORTANCE OF BRAND – RETAIL VS. INSTITUTIONAL

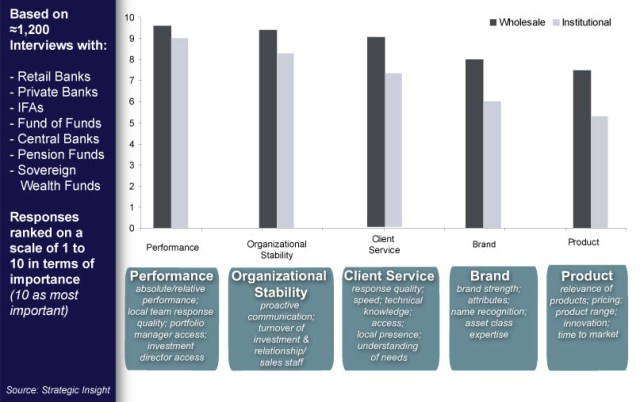

Enskat: Although it might sound like an oxymoron, our proprietary research for asset holders in Asia and globally suggests brand on the institutional side almost as important as on the retail side, for instance for institutions entering new strategies or rethinking their asset allocation and portfolio construction strategies in the context of investment solutions. Some new institutional mandates for example for PIMCO or BlackRock especially post-crisis were partially triggered by brand – and organizational stability.

Our research survey work with asset holders suggests that the key to being selected since 2008 has been to find the right mix between investment performance, service, brand and organizational stability – with growing importance of the last two as differentiating factors.

Especially in Asia both organizational stability and brand are moving up the ranks. Where do you see this mix at BNY Mellon?

Harden: The first thing I would like to do is change your question.

I think I would like to reposition the four criteria: the sum total of three of them, investment performance, organizational stability and service, i.e. the delivery of your promise, equals your brand.

Your examples, BlackRock and PIMCO, are superb companies inasmuch as they have always delivered what they promised to do. Therefore, they have a strong brand.

The next conundrum is name awareness. You can have a strong brand awareness in the institutional space by delivering on all of the above.

In the retail space, you need name recognition on top of it. That’s harder to achieve.

THE GLOBAL TREND TOWARDS BLOCKBUSTER PRODUCTS – IS BRAND PORTABLE?

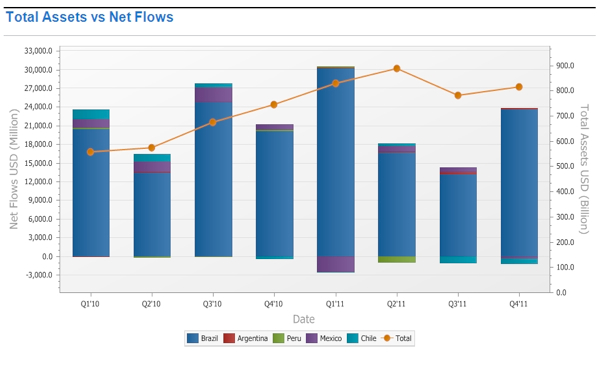

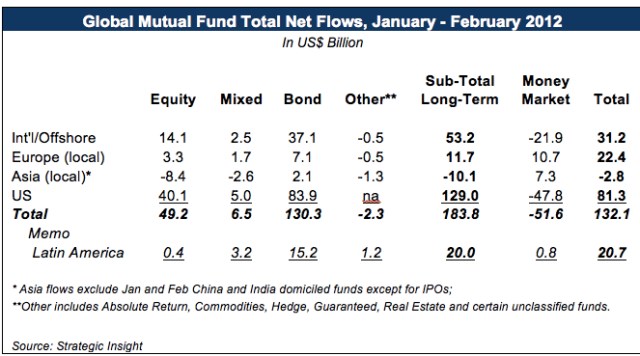

Enskat: What we are seeing globally across the industry for both retail and institutional channels is a trend towards blockbuster products. Asset holders are asking asset managers for the one or two things they are really good at. Firms that they have heard of and those they believe are best-in-class get the vast majority of industry cash flows. In 2011, while the industry globally collected $200 billion in new cash flows, the top 1% of blockbuster products combined gathered almost $1 trillion in new money – independent from investment theme or asset class.

For example, for January and February 2012 we have seen a rebound in equity appetite. Yet, the top five cross-border products worldwide year-to-date each highlight a completely different theme: emerging market equities (Aberdeen Global EM Equity), income (M&G Global Dividend), Asia (Franklin Templeton; BNY Mellon/Newton), thematic investments (Morgan Stanley Global Brands) and asset allocation (Invesco Balanced Risk Allocation).

First, congratulations on being one of the five. Second, leaving the pun of Morgan Stanley’s brand product aside, what do you make of these themes from a brand perspective?

Harden: Thank you.

I think all five companies and products you mentioned have delivered on their promises for years. Oftentimes the asset management industry is made out to be tremendously complicated. It’s actually conceptually relatively simple. Do what you said you were going to do, do it really well, and continue to do it in the future.

In order to do that, we are all very concerned about keeping the people and teams together to make sure we can continue to operate at the same high levels. If you can deliver strong holistic performance and are able to repeat it, it will drive a lot of assets your way.

In the case of the five firms above, they were able to do just that across a number of different products.

Morgan Stanley Global Brand and Newton Absolute Return are interesting because those themes are slight deviations from what they are really known for.

Thus, the question then becomes whether brand is portable across different strategies, i.e. can brand be extrapolated?

I would argue the answer is yes. Brand ultimately is a continuation of our basic promise of performance excellence. You then deliver that to the customer in a way that she or he wants it delivered.

If we can do that, and if we can continue to do that – we can extrapolate new strategies and create new fund sales, i.e. broaden our brand.

Enskat: So let’s take a closer look at who is actually able to do this best.

In my research I classify the blockbuster phenomenon as a battle of “David vs. Goliath”. On the one end of the spectrum we have large global fund managers, such as BlackRock, Franklin Templeton, PIMCO, JP Morgan and others.

On the other end of the spectrum we see fast growth for boutique names such as Huashang or Value Partners in Asia, Investec in South Africa, Carmignac or BlueBay in Europe, and DoubleLine or DFA in US.

It is very hard to operate in the middle ground, juggling economies of scale and boutique approach.

Yet, your firm represents a third approach, something that I would coin a “multi-David” structure. Investment boutique brands under a larger global parent, such as BNY Mellon, Legg Mason, 0r Natixis.

Allianz would have been part of your group, but then PIMCO decided to leave the parent firm from a distribution/brand perspective.

Is there room for multi-Davids in Asia (and elsewhere)? How do you see it playing out in the blockbuster piece?

Harden: I actually quite like the idea of 16 Davids taking on a Goliath.

It’s an interesting issue for the industry and exactly why I think multi-boutique strategies to some extent have an advantage.

Multi-Davids on a distribution/parent company level are big enough to have economies of scale and leverage organizational capabilities. We gain synergy wherever we can, across the continent and across the globe, but are nimble enough to react to markets and consumer demand, and fast enough to implement them because each boutique focuses on one thing and one thing only – investment excellence.

That leaves the parent company as the operating manager, adding value by allowing the boutiques to focus on investment performance and growing their capabilities, and supporting solutions through different distribution channels worldwide in an effective manner. This also helps as we focus on delivering client service excellence.

In my view, the middle ground is the “dead zone”.

Whenever a large organization is developing pseudo boutiques within it, or Davids reach a scale where they meet capacity constraints for their strategies, that’s when the middle ground becomes a real problem.

FROM DAVID TO GOLIATH

Enskat: Let’s take the example of Aberdeen. They have the best-selling equity fund year-to-date 2012 and are known as a global equity manager with a strong brand in emerging market equities, especially here in Asia with Hugh Young, and globally with Martin Gilbert and his acquisitions in recent years.

Let’s then add the example of PIMCO. From a brand perspective, PIMCO last year decided to build their own distribution efforts away from parent Allianz on the strength of their brand.

How does it affect your boutique brand name when you get so big that you de facto become a Goliath? Or, closer to home for you, what happens when a multi-David boutique has such a strong brand that they don’t think they need you?

Harden: Aberdeen is a superb example of a David turning into a Goliath.

I am a real fan of Martin’s leadership and what that business has done. If you go back ten years to 2002/2003, they had difficulty with the investment trust split issue in the UK, where their low share prices created a degree of concern in the marketplace. Ten years later he has bought a couple of businesses right in the eye of the storm of the crisis, and transformed the boutique David into a Goliath.

Enskat: Admittedly, given the strong name recognition of the analogy for David, Multi-David, and Goliath, we conveniently downplayed that of course in the story David emerges as the winner.

Harden: That’s perfect.

Enskat: Maybe, but which David is it? In BNY Mellon, multiple boutiques run the same strategies and compete with each other. Isn’t that confusing for the client or destructive for the group?

Harden: I appreciate the opportunity to do some marketing for BNY Mellon. There are many firms that don’t like competing strategies – we do. For example, we run global equities in four different boutiques (Newton, Walter Scott, The Boston Company, Mellon Capital). Each of the firms uses a different approach to global equities that suits different customers. By understanding the nature of problems out there and the solutions needed to address them, we can put capabilities together accordingly.

Enskat: You are in charge of Asia-Pacific, but you only have one local manager – Hamon. At the same time, over 80% of the assets in Asia are locally manufactured. With great(er) demand for local products and local expertise in Asia, how can you demonstrate brand strength for those clients? In other words, how are you going to build a brand from nothing?

FINDING BOUTIQUE 17

Harden: From nothing comes the rise of the phoenix. We have the world’s best opportunity and the necessary financial strength to capitalize on it.

Enskat: Arne (Lindman, Asia Pacific CEO for Fidelity) said yesterday that it took Fidelity 40 years and a few hundred million dollars to build their brand in Asia.

Harden: And we are as committed.

We run $1.3 trillion in assets under management globally, we have our boutique name here and our JV in China, and are ready to build that out alongside our other businesses. My working name for it is “Boutique 17”, to help build out Asia Pacific equity and fixed income strategies alongside Hamon and others, and then to grow them to a considerable degree. Profitability of course is a key issue.

Enskat: In addition to the buildout of your institutional brand here, you are also tackling the retail side. Do you consider this to be an uphill battle from a brand perspective?

Harden: The retail brand awareness is definitely a challenge. On the institutional side the BNY Mellon boutique brands travel very well, but on the retail side this is not really the case. Both BNY and other multi-David firms and boutique managers have work to do in that regard.

Enskat: Asia has had a difficult time from an aggregate asset gathering perspective since the accumulator and minibond crises in 2008, with net cash flow numbers nowhere near pre-crisis levels. The only market in Asia with sizable cash flow contributions post-crisis has been Japan. Curiously, the blockbuster themes in Japan often are co-branded products. For example, Nikko under Tim McCarthy in 2004 started the World Series platform and by 2007 had some 45 products by 30 external managers with $25 billion in assets.

On the one hand there is no common denominator across the region from a business perspective, with each local market having specific regulatory, cultural, product and distribution dynamics. On the other hand, some themes such as high yield, multi-asset or global fixed income has seen regional appeal.

Is there anything you are doing in Japan from a branding perspective that can be extrapolated?

Harden: I think the asset management business in each country in Asia is markedly different, and it is critical to manage the business from a local perspective from every aspect, including branding, production, and investment capabilities.

For BNY Mellon Investment Management APAC, Japan is by far our largest business and we have raised assets managed within the group both with our European and US boutiques.

To create packages using some of our boutiques certainly is a good example of a way to perhaps hit the ground running in the region.

One of our recent launches – and rest assured it will be on the list of your blockbuster products when it is announced – is a combo product in Japan where we bundled Urdang and Insight for a REIT strategy with a covered call. Such a high yield two-pronged strategy allows us to tap into the investment excellence of our different boutiques and at the same time develop the manufacturing side of the Asia business.

THOUGHT LEADERSHIP AND TAILORED INFORMATION DELIVERY AS BRAND EQUITY

Enskat: Let’s turn to an area of brand equity that many asset managers are struggling with. When we look at the commonalities between successful David and Goliath firms worldwide, our surveys and research shows all of them are great at proactive and tailored information delivery and thought leadership. A new key criterion for asset holders is the adaptation of a social media communication strategy, especially on the retail side.

What are you planning for your 16 boutiques, both for the institutional clients as well as for your retail development.

Harden: All of our boutiques produce thought leadership around their investment philosophy, but the challenge is how do you get that to the client and consumer in a meaningful and thoughtful way.

Enskat: Scorpio’s latest wealth management survey for the region stated that while asset managers view their relationship and communication with clients as 90% numerical and 10% emotional, HNW investors see it exactly the other way around. Does the industry have a massive communication challenge with its customers?

Harden: I think we communicate reasonably well with our institutional customers, whether in person or through other channels. Clearly, we are always more into mathematics and numbers in some shape or form. On the other hand many of the blockbusters you mentioned are thematic in nature. I think that is because they are trying to provide a solution for a problem, and that is normal.

Enskat: Are thematic blockbusters and investment solutions a “new normal”? We now globally have some $4 trillion in investment solution wrappers worldwide and these products collectively attracted over $100 billion in new money last year.

Harden: For us, thematic asset management allows us to have different capabilities across our groups come together to create a solution. We just have to figure out which problems we are going to face globally and from a macro perspective to create some form of solution that customers have the choice to invest in. BNY Mellon to that end recently sponsored an EIU thought leadership study on “the search for growth – opportunities and risk for institutional investors” that looked at a scenario heat map of probably future scenarios.

MULTI-CONVERGENCE AND BRAND

Enskat: Multi-convergence, the blurring lines of demarcation between retail and institutional processes, the product convergence between traditional and alternative approaches, different investor mindsets between developed and emerging markets, and the interdependence and competition between local and global regulation is fundamentally changing the industry. But it goes beyond just our industry.

Culture at large is converging and brands need to respond to it.

Interbrand in its 2011 analysis of the best global brands summed it up with “collaborate or die”.

Among the collaborations highlighted are BMW and Guggenheim (with their portable science labs), Coca-Cola and Heinz (the energy efficient PlantBottle), or Gucci and Unicef (high profile attention benefitting both brands). From an asset management perspective, would you consider teaming up with another business in retail conscious approaches to raise the profile of your brand (or the industry)?

Harden: If we continue to just do the same, we are never going to reach the levels of penetration necessary to provide innovative solutions to our customers. It is our role to find new strategies or product structures that may exist in one part of the world, and bring them to other parts of the world – or different client segments.

That is the great benefit of this industry becoming more and more global.

At the same time, the complexity calls for partnering with different groups to find innovative ways of thinking through delivery. One of our team members last night taught us how to tweet and we now feel very modern.

Who wouldn’t want to join up for instance with Apple and develop an investment program.

Enskat: Especially since they announced earlier today that quarterly revenues from Asia doubled, to over $10 billion.

Harden: Exactly.

You must be logged in to post a comment.