In my keynote speech in Aberdeen this summer, I referred to my firm’s research around volatility and risk management as “ROVO” – Return Optimization around VOlatility. In the overall risk-on/risk-off approach by institutions and private wealth managers post-crisis, volatility considerations, both for macro issues as well as for portfolio construction and asset allocation, has seen greater attention. This is especially visible with pension plans as they try to straddle liability hedging versus return seeking in their dynamic asset allocation.

Thus, Natixis created a new 32 people volatility management and structured product team called Seeyond around four areas of expertise – structured beta & guarantee, smart beta, hedged beta, and flexible beta & volatility.

Northern Trust earlier this year published a white paper with Greenwich Associates, “Customised Beta“. Addressing broader policy goals beyond just outperforming a benchmark, passive strategies have been restructured from traditional capital weighted to alternative and customized indices. To that end, the firm followed up its US TILT product on the FlexShares platform with one focused on developed markets and another one tilting emerging markets – part of the evolution of targeted sophisticated investment approaches.

Tilt investing moves portfolio allocations toward a specific factor to gain an excess return relative to traditional capitalization-weighting approaches, aiming to take advantage of market anomalies. New products in this field can be found also from giants BackRock and State Street, both on the forefront of mixing active and passive approaches for intelligent beta products, blends and hybrids.

State Street launched tilt ETFs (Value and Momentum) to the SPDR series. According to the SPDR university’s “case for tilt investing“, tilt investing has become increasingly popular among institutional investors. They are moving away from pure capitalization-weighted portfolios by introducing advanced indexing that tilts toward factors that have shown long-run outperformance in academic research (most notably by Fama and French). Factors away from market cap can include dividend yield, price earnings, price cash flows, price versus book or sales, ROE, EPS growth, and much more.

BlackRock under its BMACS platform (“Multi Asset Class Solutions”, not to be confused with Big Macs) has some 130 portfolio managers, researchers, investment strategists, economists, and actuaries creating solutions for clients. Nine investment strategies range from hedged equity to dynamic multi asset and target risk. Market advantage as a strategy constructs beta to a diversified set of asset classes in a single, efficiently-constructed portfolio to deliver global equity returns with less risk. In other words, identify a portfolio with the highest Sharpe ratio and leverage it up or down to desired return levels.

One of Lombard Odier‘s unlimited partners, Hubert Keller, thinks the industry needs to completely reinvent itself from a risk management perspective. The firm’s own pension fund has moved from traditional asset allocation managed externally to 30% illiquid assets and the other 70% in a risk budget with specific drawdown budgets (8% max drawdown with about 6% volatility), marketed to LODH clients as well.

Approaches of risk and factor based approaches rather than asset classes has been discussed a lot in the industry, especially with managers such as as Bridgewater or AQR accumulating tens of billions of dollars in client assets around risk management. Bridgewater’s All Weather fund in 1996 was the first official risk parity fund.

European and Canadian along with leading US plans have increasingly implemented new investment approaches in recent years. For example, Denmark’s ATP in order to minimize large drawdowns in addition to risk parity first hedges all uncompensated risks (in this case interest rate risks vs. liabilities) through a separate hedging portfolio of ultra long duration interest rate swaps and government bonds. Next, tail risk is addressed by purchasing downside protection and, finally, a dynamic rule with specific risk budgets on reserves protects solvency ratios if all else fails.

The way I see it, the difficulty to balance risk and liabilities with maximum risk adjusted returns is further fueling the process of #Multi-Convergence in the investment management industry, an area of great focus for E&A and the main theme of EAQ3, coming out this week.

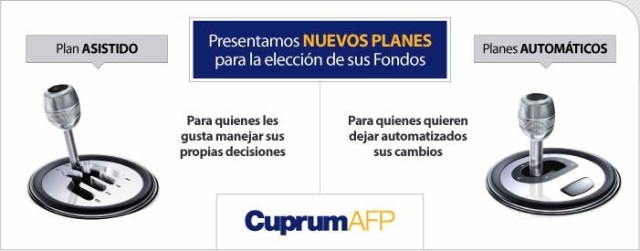

Products: convergence between active and passive and traditional and alternatives

Distribution: convergence between institutional investors, global gatekeepers, wholesale, and retail

Regulation: convergence between global frameworks and local silos

Geographies: convergence between developed and emerging regions, aka fast and slow growth

Scale: convergence between core and satellite strategies and with it appeal of boutique specialist brands versus large global investment houses

Co-opetition: convergence between asset holders, asset managers, consultants and advisors, leading to competition, cooperation and conflicts of interests, which will benefit a selected few.

Concentration: all of these trends combined lead to increasing concentration of flows to strategic partners and strong brands, as due diligence, compliance and research efforts blow up budgets and investment resources.

Lots of challenging questions, but intellectually very appealing.

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2012

You must be logged in to post a comment.