The picture is simple.

Sovereign funds, in Asia-Pacific and the world at large, act as a leading indicators for the investment management industry. They have long-term capital to play with and are willing to take calculated risks in alignment (hopefully) with their asset management partners.

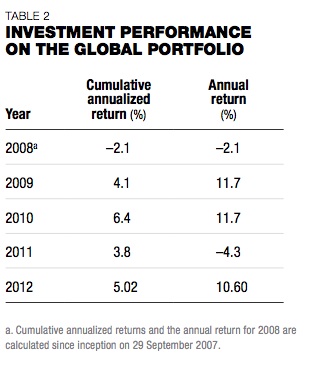

One of the largest of them, CIC, celebrated its fifth anniversary this week, with annualized returns for overseas investments of 10.6% (compared to a cumulative one of 5% since inception) – it pays to invest globally, it appears.

After studying the asset allocation frameworks of major institutional investors around the world, Ding Xuedong in his message highlighted an extended investment horizon of a decade with rolling annualized returns as the benchmark and the continuation of the endowment model of investing as the framework.

Further focal points were on using Hong Kong and Toronto as hubs to interact with the world and post-investment management of illiquid investments in infrastructure, energy, mining and PE allocations. Outgoing chairman Lou Jiwei described his 2,000 days at the helm to “a ship emerging from a storm”, with “a bright future with renewed confidence”.

A quick review of the corporate structure:

– CIC was launched in 2007 with $200 billion in registered capital to diversify China’s forex holdings.

– CIC International started in 2011 to manage overseas assets, since then receiving an additional $50 billion to invest.

– Central Huijin holds controlling stakes in important state-owned financial institutions in China.

– International offices are Hong Kong (established in 2010) and Toronto (rep office, 2011)

Highlights from last year, including direct investments:

– February: 2012-2016 Strategic Plan of Development approved

– June: Russia-China Investment Fund created

– July: CIC Culture Consensus established

CIC combines strategic asset allocation, policy portfolio and tactical allocations into its three layer asset allocation framework from longest to mid-term and short-term in nature. An interesting component of the process is the internal dealing room to gradually build up in-house investment management expertise side by side with external partners.

After completing its portfolio transfer, Hong Kong now is in charge of global credit products and China concept stock investments. Toronto continued to build up communication with local governments, institutions and communities to identify promising investment opportunities.

Let’s take a closer look at the investment specifics: overseas investments as mentioned above reached 10.6% compared to losses last year.

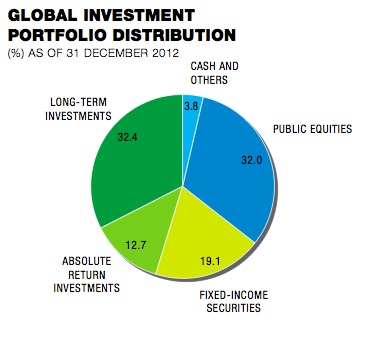

The global investment portfolio has one third of assets each in long-term investments and public equities, as well as now close to 13% in absolute return investments.

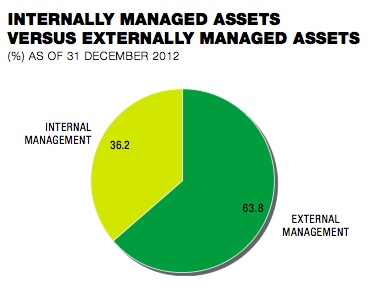

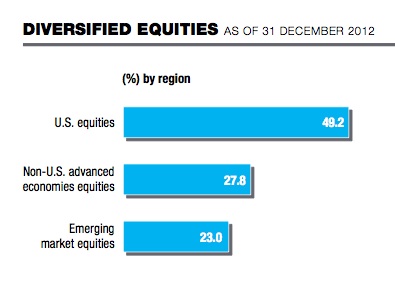

Good for investment managers is that CIC continues to have two-thirds of their assets managed externally, especially in the case of diversified equities, shown below. Half is in US equities, followed by some 28% in non-US advanced economies. Notably, 23% are in emerging market equities.

And a few more numbers:

– CIC’s total assets in 2012 increased from $480 billion to $575 billion, with some $356 billion in long-term equity investments.

– Total investment income jumped from $50 billion to $85 billion ($63 billion from long-term equities).

In this era of multi-convergence between products, distribution, geographies and regulation, CIC especially focused on the talent management side of its five year strategic plan with the goal to make CIC a “recognized brand for financial professionals”.

E=MC2 … The era of multi-convergence in global investment management.

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2013

(c) Warren Enskat 2013

More details on the global M&A in the asset management industry can be found in EAQ, a regular asset management review featuring thought leaders globally.

You must be logged in to post a comment.