The decisions of the most sophisticated pools of assets globally are studied closely for guidance on how the overall industry will evolve. The history of SWFs started with KIA in the 1950s and Middle East SWFs in the last sixty years have been on the forefront of institutional investing and leadership as sophisticated long-term based pools of assets.

Invesco in partnership with research house NGM for four years now has published the Invesco Middle East Asset Management Study (IMEAM) and their findings are always insightful.

Based on target returns, investment horizons and risk appetite, they group sovereigns into either development or investment SWFs. As shown above, development SWFs interestingly have a notably higher target return (14% vs 8%) and more active management, typically using a private equity style model.

Private equity is a key instrument used by both development and investment funds, with year-on-year PE allocation for investment sovereigns in the last three years almost tripling from 5% to 13%. Just as other sovereigns have done, smaller SWFs start with private equity allocations first, and then often move into co-investment and direct investment vehicles, to have greater control and alignment of fees and returns – on the other hand, sovereigns have to be large enough with in-house staff that is sufficiently familiar with the complexities of private equity selection and investing to go down that path.

Importantly, the study sees state pension funds emerge as a crucial second institutional segment for asset managers, as growth rates for pension funds accelerate and their allocations shift from local to international.

For now, however, the level of sophistication between pension funds varies widely, with some of them building in-house allocation models while others rely mostly on global consultants. Others still are just starting up.

The most promising and profitable segment, of course, are HNW and Ultra-HNW investors in the region – the single and multi family offices. The good news is that there is now less money flowing from personal to corporate assets with reduced funding requirements in a healthier economic setting. Also, international allocations have grown strongly in the last three years.

But back to the key trends for family offices in the Middle East according to IMEAM:

First, single family offices are the preferred route compared to multi family offices given the intimacy of relationships and sensitive nature of large personal wealth decision making. The study calls it the challenge for multi family offices to handle control, trust and confidentiality. As such, multi family offices uncomfortably fall between single offices and international private banks, often lacking competitive advantages to compete with either one.

Second, the day-to-day business requirements are notably different, as shown below. For instance, fund selection and asset allocation are a core proposition for multi family offices with 83% and 67%, while only 23% and 8% of single family offices see it as such.

Conversely, 54% of single family offices see M&A investments as a key service, compared to a clear ZERO for multi-family offices. Same with the sensitive subject of succession planning, where the ratio is 31% to 0%.

In all, multi-family offices only handle a small share of a family’s assets, and thus offer mostly fund selection and asset allocation advice, while single family offices are intricately involved in the family’s overall decision making.

All of this is good news for global private banks, as they should be able to successfully gain market share on the selection and allocation piece of the pie. And as personal and corporate assets for UHNW investors remain joined at the hip in the GCC, there is much growth potential.

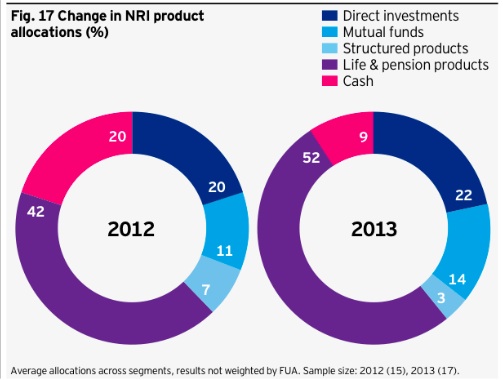

Lastly, let’s look at product allocations.

A few highlights:

– Cash allocations compared to last year have decreased from 20% to 9%.

– The use of mutual funds is growing, from 9% to 14%, while structured products fell from 7% to 3%

– Life and pension products grew 10% to 52%.

– Direct investments stayed largely the s

Summary points:

1. Investment and development SWFs have different target return objectives and investment horizons

2. Private equity models are dominant, in a variety of structures depending on resources

3. State pensions are emerging as a crucial second institutional segment in the GCC for asset managers

4. Growing HNW opportunities, but demands for single and multi family offices vary widely

5. Fund selection and asset allocation expertise is in demand and growing

6. Cash allocations are decreasing, benefiting mutual funds, life and pension products

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2013

More details on the global M&A in the asset management industry can be found in EAQ, a quarterly asset management review featuring thought leaders globally.

You must be logged in to post a comment.