Just touched down in New York after a week of meetings and speeches in Latin America around the annual Fund Forum. With the Selic rate down 525 bps to 7.25%, the industry for the first time in years is seeing an inflection point that is likely to open up Brazil to greater global participation, alongside product proliferation and innovation.

Some of the major themes from discussions with and overviews from the CEOs of the largest LatAm distributors and banks including Santander, HSBC, BBDTVM, Bradesco, and Itau:

All distributors are preparing investors for a shift in investment products. A number of CEOs think the old adage of “this time is different” does apply, with clients according to many of them in the first stage of grief: denial (about interest rates).

Thus, Brazil is likely to see demand for new investment themes across sophistication levels, including more risk, illiquidity, alternatives, real estate and more. Where in the past investors comfortably earned 8% in ultra low vol stable products, which account for some 70% of products, those returns now stand at less than 80bps.

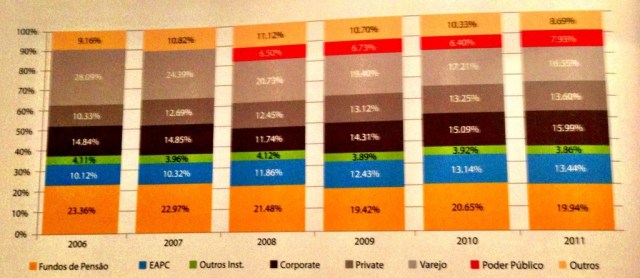

Industry AUM according to Anbima stood at R$1.9 trillion last year, making Brazil the sixth largest fund industry in the world. Net cash flows in the last three years exceeded R$325 billion. Notably, R$18 billion of new cash contributions last year went to the fast growing EAPC (Entidades Abertas de Previdência Complementar (open private pension funds)).

I detailed many of the opportunities in the region last year in Strategic Insight’s State of the Industry – Latin America, as we developed a database for the local and global products available in the market.

The interest rate is now at the lowest level in Brazil’s history, and the higher risk appetite has spurred growth in areas like real estate, which has grown over one third this year alone. Those products used to be the terrain of HNW investors via private banks, but are now rapidly moving downward into the retail segments.

Similarly, the whole palette of alternative themes is gaining traction. I assume strong growth in coming years for private equity and other alternative vehicles based on client discussions and market analysis.

The interest rate drop de facto forces distributors’ hands down the road of product proliferation and innovation. Part of the challenge will be to change investor mindset, away from 1% return per month as a God given right.

2013 will be a litmus test in that regard. As product innovation takes off, investors already have a hard time understanding what they are buying, as visible with some of the complexity in the real estate products that have been gobbled up.

In all likelihood, this will help the advisory business and the provision of holistic investment solutions, as wealth management is picking up speed. We have seen Julius Baer buying a stake in GPS and other local advisory firms being acquired. And with BTG Pactual just having moved into a brand new powerhouse office on Faria Lima, their focus post acquisition spree has gone from local to regional and global.

Of course, speculation runs high for exactly when foreign investors will be able to get a larger share of the business in Brazil. The equity market will become much more important in coming years, along with greater participation in a true alternative segment of the markets, away from the inhouse managed multi mercado businesses of firms like Petrobras.

Products are shifting away from passive to total return themes with a gradual increase in risk exposure. The middle class is growing stronger and they are now starting to diversify their holdings. Pension funds, although already able to invest ten percent of holdings abroad, in reality still do much less than that, but it is slowly changing.

Regulation and industry associations are also increasingly looking globally to learn, influence and participate in the globalization of the industry. Anbima has new project in the pipeline and the CVM is readying the market for new vehicles.

As I have written in recent entries, CIC invested directly in BTG Pactual and there are a ton of agriculture, infrastructure and other co-investments being developed by a variety of institutional investors. Firms like Itau in Japan or Europe are expanding globally, and the other large domestic brands are following in those footsteps.

Notably, while the rest of the world is going passive, active management and diversification is becoming more important in Brazil, away from index Bovespa to total return and thematic approaches. And the fixed income world is ripe for a wave of innovation along the credit, market and risk spectrum as well.

Aside from my keynote speech at the Fund Forum LatAm, I conducted a masterclass on local and global distribution with executives from BTG Pactual and Afina: Ricardo Kaufmann and David Godfrey-Thomas. A large group of firms is assessing market entry strategies or, vice versa, global expansion.

With this boom of managers in Brazil, the question will be which one of the thousands of local (and offshore) products will become the next local or regional blockbuster fund. Whether equity as an alpha play, development of a true third party multi mercado business, or macro hedge funds and private equity propositions, an emphasis has to be on protection of the industry and its growth by producing simple products for Brazilian investors across income levels, despite an increasing level of complexity.

This dichotomy should not be too far a stretch for Brazil, where six-lane multi-hour traffic delays go hand in hand with Brazilian style pizza on the rooftop of the Skye bar featuring a breathtaking panorama of the São Paulo skyline.

Goodbye SP, hello NY.

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2012

More details on Latin America and the global asset management industry can be found in EAQ, a quarterly asset management magazine featuring thought leaders globally: