Last week, Spanish prime minister Mariano Rajoy used a LatAm summit to ask business leaders to invest more in Spain as a platform for growth in Europe, Asia, and Africa – “Spain receives Latin America investments with open arms.”

Cool.

Also quite a turnaround from a historical perspective. In turn, LatAm executives now think that Spain, Portugal and others have a lot more to learn from the success recipes in LatAm than the other way around. I commented on examples such as the multi-mercado lessons for Newcits and the Chilean La Polar-Dublin investment fund scandal in a recent book.

And indeed, we have seen many US and European firms aggressively expand in the region, such as Principal Group with multiple cross country acquisitions, Julius Baer with GPS, Credit Suisse with HG, or, very recently, the CIC with direct investments into BTG Pactual.

Conversely, the banking, pension and insurance businesses in Mexico and South America are hugely important indicators for Spanish groups such as BBVA or Santander.

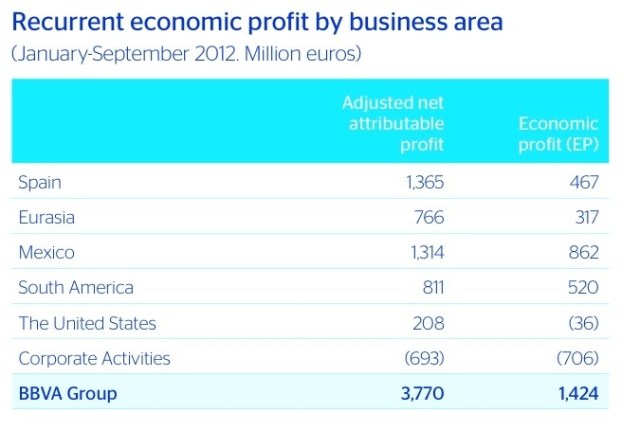

For example, BBVA as per Q3/2012 earnings saw Eur3.8 billion in adjusted net attributable profit, and Eur1.4 billion in economic profit, shown below. Of that total, Mexico alone accounted for almost twice as much in economic profit as Spain.

Mexico combined with the rest of South America overall totaled more than 100% of economic profit for the group (side note, Eurasia is catching up fast with Spain from a profit perspective as well).

What about some of the other indicators?

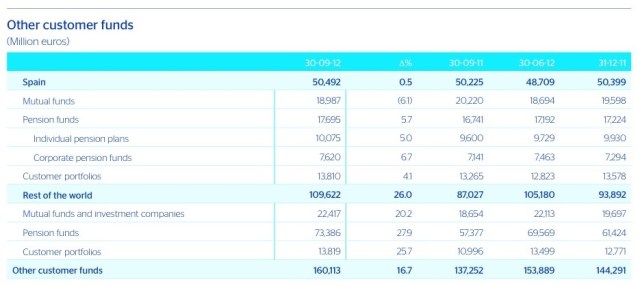

Away from balance sheet funds, Eur110 billion of the Eur160 billion in customer funds come from outside of the domestic market. Importantly, pension fund assets of Eur18 billion in Spain compare with Eur74 billion non-domestically.

Mexico stands out because of strong retail activities, double-digit growth for retail deposits, positive insurance performance, sustained recurring revenues and multiple strong issues of capital notes on international markets.

Customer funds, including on-balance sheet deposits, repos, mutual funds and investment companies, and pension funds, grew 7.2% year-on-year to Eur76 billion in September 2012. Through Q3, the pensions and insurance unit generated Eur275 million in net attributable profit, up 14% over Q3/2011. Those numbers were partially due to strong earnings from the ILP, Creditón Nómina, VidaSegura, HogarSeguro and Transacción Segura products

Other highlights:

– Dinero Móvil BBVA Bancomer, launched in September 2012, is a service that allows the ability to send money to any part of Mexico via Internet, ATMs or cell phones. The recipient of the deposit receives a message with a password giving access to the cash through ATMs in the BBVA Bancomer network, without the need for a debit card or a bank account.

– BBVA Bancomer in July issued 10-year additional capital notes for $1 billion on the international markets, 3.5 times oversubscribed. A $500 million renewed issue in September was three times oversubscribed.

Investors are confident.

– The Mexican Center for Philanthropy (Cemefi), Alliance for Social Responsibility in Mexico (AliaRSE) and Forum Empresa granted BBVA Bancomer the “Best Corporate Social Responsibility Practice” award in the “Community engagement” category for the mutual fund B+Educa, the first of its kind created by Mexico to support the “Por los que se quedan” (For those left behind) social integration scholarship program.

This is one of the areas that hopefully will grow strongly in the future, as asset management firms, institutional investors and distributors are becoming more aware of their social responsibilities and the long-term investment provisions they create and provide.

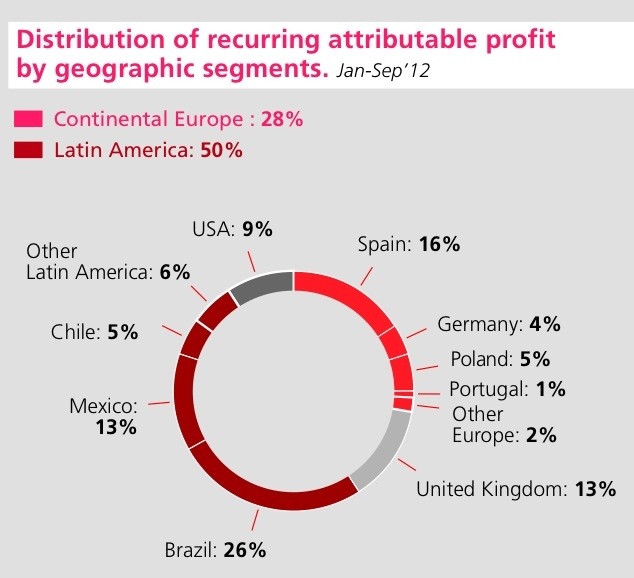

For Santander, 50% of profits come from Latin America, led by Brazil and Mexico, compared to 28% from continental Europe.

Continental Europe had attributable profit of Eur1.8 billion, or over 10% lower year-on-year. The decrease was mostly due to provisions made in retail units in Spain and Portugal. The UK, on the other hand, grew by 4% to GBP700 million.

The profit center for the group through Q3 was Latin America, with Eur3.3 billion, about twice as much as Europe. In local currency terms, gross income increased by 14% and net operating income rose almost 18%. Yet, profits shrank by 4% because of higher provisions, taxes and the perimeter effect. Excluding the latter, attributable profit rose 4%.

Santander Asset Management is still in the process of creating a global business model based on management capacities at the Group level and on the knowledge of local managers. During the quarter, as part of a reorganization of the business around a holding company for all fund management entities, Spain, Argentina, the UK and Luxembourg were integrated, and the structure of the management teams for Latin American mandates and for the global European mandates have been finished – all of which facilitating entrance into the institutional market.

A few highlights:

– profit for the Group (profit before tax plus fees paid to the networks) was Eur 775 million, 4.5% down year on year.

– overall assets stand at Eur140 billion, unchanged from 2011, with Eur100 billion in mutual and pension funds, Eur7 billion in client portfolios other than funds, and some Eur30 billion in institutional mandates. Of that total, 86% comes from Brazil, the UK, Spain and Mexico.

– Brazil has Eur45 billion in AUM, up 4% excluding exchange rates. A weakness in retail funds (-10% from 12/2011) was offset by growth in institutional mandates, both from third parties and the Group.

– UK managed funds increased 9% to Eur27 billion. Mutual funds were stable: good acceptance of multimanager funds offset market declines.

– Spain was in net outflows. Santander got out of money market and focused on profiled funds. Including pension plans and mandates, fund assets decreased by 3% to Eur36 billion. One bright note were new mandates from institutional German clients.

– Mexico continued to launch new risk profile funds and guaranteed products, which helped to improve the asset mix: Eur 11 billion, up 3% from last year in pesos.

– Argentina and Poland grew 13% and 15%, respectively, from a lower base. In Portugal, liquidity driven deposit switching activity produced a 10% decline in mutual and pension fund assets.

– non-traditional assets (real estate, alternative management and private equity funds) hovered around Eur3 billion.

By and large, we see an increasing trend towards what I dub “emerging market bridges”, more direct activities between fast growth, emerging markets. At the same time, developed markets are shifting more resources and talent towards developing Latin America and Asia. Lastly, multi-convergence benefits those firms that are able to build a global business model with local expertise and brand silos.

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2012