When writing about Latin America, one cannot avoid looking at the example of Brazil. When writing about Brazil, one cannot avoid looking at the example of BTG Pactual. I have clearly written a lot about the firm in recent months (M&A, IPO, business celebrities, and more), but for good reasons.

Record growth for BTG Pactual

In its third quarter release, BTG reported an increase in AUM to over R$160 billion, up some 18% year on year, with the acquisition of Brazilian Capital adding R$11 billion in real estate fund assets.

Year to date revenues of R$4.9 billion and net income of R$2.4 billion represented growth of 120% and 176%, respectively in comparison to Q3/2011.

CEO Andre Esteves pointed to the focus on regional expansion as the driver for being awarded the 1st position in Latam research by Institutional Investor, the first time a Latin-American institution received the award.

Macro picture in Brazil appealing for asset and wealth management

On the monetary policy front, the Selic rate was cut by 100bps in Q3/2012 and again by 25bps – to 7.25% – at the latest Monetary Policy Committee meeting in early October, a total of 525bps for the monetary easing cycle. The committee clearly stated its intention to remain at current levels for a while. Still, 12.5% Selic vs. now 7.25% shows greater opportunities for the asset management industry going forward, both from a diversification and return perspective.

But back to the details for BTG.

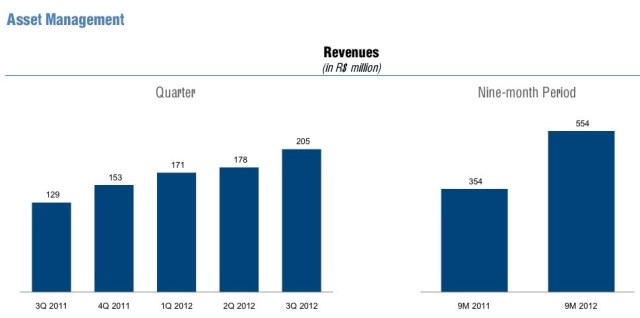

Asset management revenues grew 15% to R$205 million, in line with a 14% AuM/AuA increase – this includes R$11 billion in new assets as a result of the August acquisition of Brazilian Capital -, to R$151 billion.

Pockets of excellence: Global hedge, Brazil bond and Brazil equity funds

Year on year, the asset management business benefited from an increase especially in performance fees, specifically for global hedge, Brazil Fixed Income & Brazil Equity Funds. Net flows reached R$4.3 billion on the strength of the strategies mentioned before, while fund services were a drag.

The themes are interesting, indicating on the one hand continued local fixed income strength, but also a pickup for equity themes in Brazil. Interestingly, while hedge funds globally have had a difficult time post-crisis, the multi mercado business in Brazil and the global hedging theme continue to be appealing. Indeed, other firms such as Blackstone (recently discussed) also have been able to add cash net new flows to hedge strategies.

A closer look at client distribution reveals a stable picture year on year, but with a greater trend towards multi-convergence and client diversification, “other” clients increased by 6% to now 23% of the total.

Wealth management shows growing revenues via investment funds

The third quarter was one of the best in recent history, with R$55 million in revenues. Importantly, much of those revenues came from the growing proportion of investment funds in client portfolios, shown below.

Investment funds have grown from R$22 billion last year to R$26 billion in Q3/2012, an increase of almost 20%. Revenues from wealth management shot up 55%, to R$55 million, following an increase in WuM from R$41 billion to R$44 billion. The increase in WuM is mostly attributable to some R$1 billion in cash contributions and a positive mark-to-market of the assets under custody.

Separately, BTG in September increased its liquidity profile through the issuance of two Banco BTG Pactual bonds: US$800 million in subordinated notes totaling at a fixed coupon of 5.75%, priced at 98.14% and maturing in September 2022; and US$200 million in principal amount of senior notes, denominated in Colombian pesos, at a fixed coupon of 7.00% and maturing in September 2017, marketed primarily to investors in Latin America.

BACEN at the end of October authorized BTG’s acquisition of Celfin Capital, with the transacton anticipated to be concluded in the fourth quarter.

In sum, BTG:

– has been on a buying spree with Celfin, Brazilian Capital, and other local acquisition

– is now the top brand for Latin America by a growing number of measures

– is posting strong growth for investment banking, asset and wealth management

– competes with large global firms for EM and regional mandates at top institutions

– shows strong revenue growth via investment funds

– global hedge funds as well as Brazil bond/equity funds are in demand

– sees a diversifying client base

And, the much lower Selic rate overall is changing business dynamics within and outside of the country. Interesting times for Latin America and the world of investment management, as the convergence of geographies, products, clients and regulation is creating both greater complexities as well as remarkable opportunities.

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2012