As mentioned in my recent postings on institutional investors, SWFs have increased their interest and stakes in private equity firms in the crisis. CIC took a 10% stake in Blackstone, ADIA acquired 7.5% in the Carlyle Group.

Among the highlights from the Carlyle Group for the third quarter:

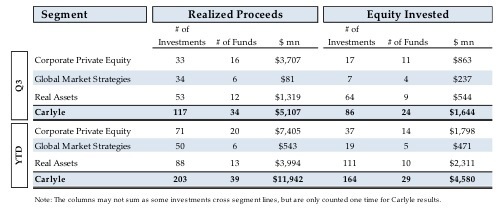

– $5.1 billion of carry fund realizations in Q3 2012, with $11.9 billion in realized proceeds year to date

– $3.4 billion in new capital raised during the quarter, $9.4 billion year to date 2012. At the same time, $1.6 billion in carry fund equity were invested in Q3. $4 billion in the pipeline for transactions expected to close in the next few quarters.

– lastly, U.S. GAAP net income attributable to the Carlyle Group L.P. stood at $19 million, or $0.40 per common unit on a fully diluted basis for Q3.

David Rubenstein attributed the $3.4 billion in fresh capital to investor confidence in the firm’s global alternative model and the recent performance.

Interestingly, William Conway aside from the US and Europe, cited especially emerging markets, “from Brazil to Turkey to China are great places to invest right now.” For Q3 2012, total revenue was $859 million, compared with revenue of $(60) million last year. Total balance sheet assets were $30 billion as of September 30, 2012 compared with $24.7 billion in 2011.

Carlyle evaluates business performance on four metrics, known as ” the Carlyle engine”: funds raised, equity invested, fund valuations and realized proceeds for fund investors, a shown below.

During Q3, Carlyle generated net realized proceeds of over $5 billion from 117 different investments across 34 carry funds. The firm deployed $1.6 billion of equity in 86 new or secondary investments across 24 funds. In addition, Carlyle committed to invest $4 billion in equity across 10 transactions that were announced in Q3, expected to close in coming quarters. Below is a breakdown of these investments, with a majority of gains from corporate private equity.

Realized performance fees reached $156 million, up by 106% quarter on quarter. For the current quarter, Carlyle’s revenues were positively impacted by public equity exits in China Pacific Life, Kinder Morgan, Dunkin Brands, and SS&C, as well as multiple private company sales.

Over the last twelve months, net performance fees approached $600 million, up 7% from the prior 12-month period.

Economic net income of $220 million was positively impacted in Q3 by 3% appreciation in Carlyle’s carry fund portfolio, excluding structured credit, hedge funds and Fund of Funds Solutions vehicles. The fund appreciation was driven by increases in Buyout, Real Estate and Global Market Strategies carry funds, offset by a decline in Energy funds, and flat performance in Growth funds.

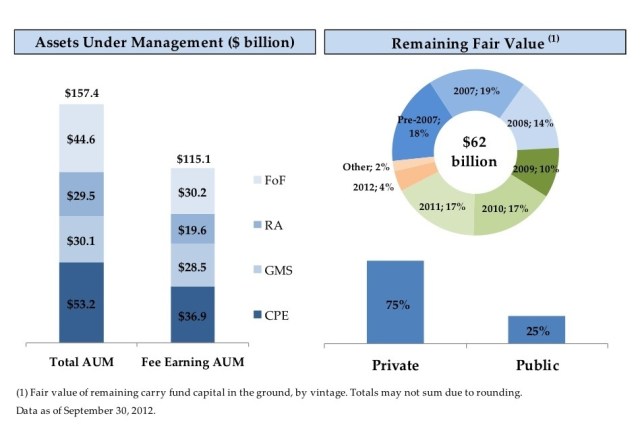

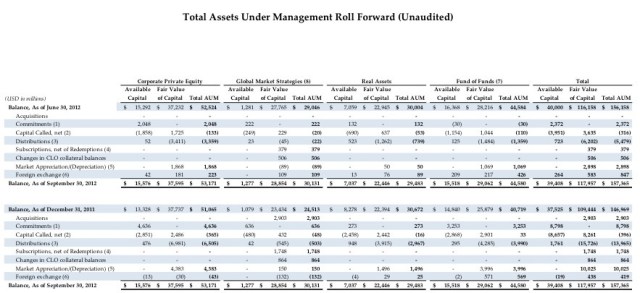

Total assets for the group approached $160 billion. Increases versus year-end 2011 were primarily due to fundraising, portfolio appreciation, increases in Global Market Strategies due to CLO creation, new carry funds, and acquisitions. Total dry powder of almost $40 billion includes Corporate Private Equity ($15.6 billion), Global Market Strategies ($1.3 billion), Real Assets ($7.0 billion), and Fund of Funds Solutions ($15.5 billion).

Fee-Earning AUM for Carlyle stands at $115 billion. Among the quarter on quarter changes were fee earning asset inflows (+$3.8 billion), foreign exchange impact (+$679 million), hedge fund net subscriptions (+$407 million), change in the par value of CLO collateral (+$171 million), and net distributions and outflows (-$1.7 billion). Carlyle Partners VI will not increase Fee-Earning AUM until the predecessor fund (Carlyle Partners V) is substantially invested, which is expected to occur in the first half of 2013.

For corporate private equity, assets stood at $53.2 billion, up slightly by 1%. Fee earning AUM of $36.9 billion was flat quarter on quarter. Funds raised of $2.0 billion was driven by the second closing of Carlyle Partners VI, as well as closings in the U.S. mid-market buyout fund and various co-investments. Year-to-date, funds raised of $4.8 billion compare to $1.3 billion for the same period in 2011.

Assets for global market strategies reached $30 billion, up 4%, while Fee-Earning AUM of $28.5 billion increased 3% compared to Q2 2012. Hedge fund net inflows were strong at $379 million in Q3 2012 and $1.7 billion in year-to-date net subscriptions, resulting in total hedge fund AUM of $9.8 billion. Specifically, a third new Collateralized Loan Obligation (CLO) raised $615 million in assets. GMS Carry fund AUM ended the quarter at $3.5 billion, total structured credit AUM ended the quarter at $16.9 billion.

In October Carlyle acquired a 55% ownership position in Vermillion Asset Management, a commodities focused investment manager with $2.2 billion in assets – reflected in Q4 results.

For real assets, total AUM is $30 billion, down 2% versus Q2 2012 due to distributions of $1.3 billion and flat carry fund performance. Fee-Earning AUM of $19.6 billion was largely flat versus Q2 2012.

Assets for FOF solutions were flat $45 billion, but Fee-Earning AUM of $30 billion increased 9% versus Q2 2012. Those gains were due to the initiation of fees on several 2012 mandates that made their first investment during the quarter and began charging fees on total investor commitments.

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2012