China at the 18th Party Congress starting this week is electing a new leader – a busy year of change for China and the world. On the investment side, CIC with now some $485 billion in AUM similarly is undergoing tremendous changes since its pre-crisis launch in 2007.

CIC in the downturn increased the flexibility of the portfolio while also changing the asset allocation framework post-crisis. In 2011, the board extended the investment horizon to ten years as part of its long-term investment approach.

Changes to asset allocation and risk management in this context included new positions in non public market assets, especially direct and private equity investments in energy, resources, real estate and infrastructure (with investments in of $5b in Morgan Stanley and $3b in Blackstone, as discussed here).

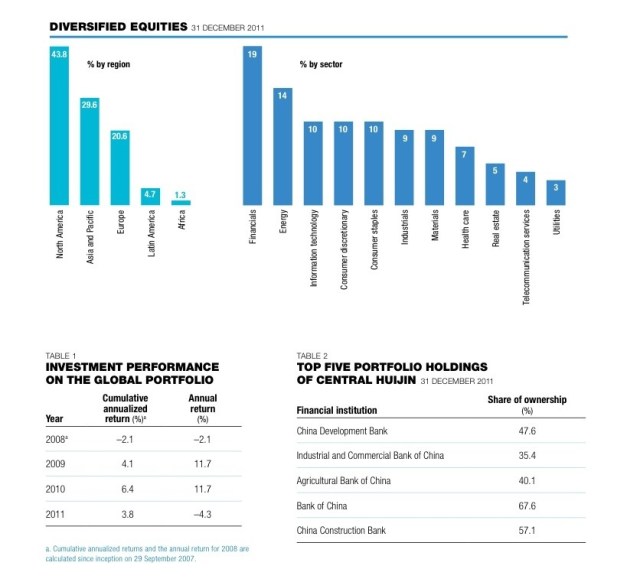

The second big focus area for chairman Lou Jiwei and the board was on the refinement and enhancement of the overall risk management systems. 2011 returns for the global investment portfolio were –4.3%, with the cumulative annualized return since inception at 3.8%.

CIC’s mandate when it was established in September of 2007 was to invest a portion of China’s foreign reserves overseas, with the objective to maximize returns at a prudent level of risk. In December 2011, CIC received an additional $30 billion to enhance that role.

A big focus in 2012 was on overseas branches to improve the ability to manage worldwide investments, with senior management appointments in HK, further built out of the CIC rep office in Toronto for stakeholders in North America and more ties with business partners to create mutually beneficial investment opportunities.

From an operational and investment perspective, CIC’s portfolio mostly contains financial products and direct investments, balanced between traditional and alternative vehicles. Central Huijin Investment Ltd. (Central Huijin), a wholly owned subsidiary of CIC but with completely separate operations, holds controlling stakes in key state-owned financial institutions in China, including recapitalization of selected domestic financial institutions.

CIC has an International Advisory Council of 15 internationally prominent experts, who provide global views on global economic, investment and regulatory issues. Their discussions and counsel broaden the perspective of CIC’s leadership and efforts to expand overseas investments. In July 2011, the International Advisory Council met for its third annual meeting in Guiyang, Guizhou Province.

The board of directors in addition to the CEO and President includes the deputy ministers of finance and commerce, the deputy governor of the people’s bank of China and the deputy administrator of SAFE. The supervisory board includes the vice chairmen of the CSRC and the CBRC. I will have a dinner discussion with the former next week alongside all key China asset managers.

– CIC’s Strategic Asset Allocation has five asset classes: cash, equities, fixed income, absolute return investments and long-term investments.

– Absolute return investments are primarily hedge funds.

– Long-term investments are primarily private equity investments in resources, energy, real estate and infrastructure, and direct investments in other industries.

– In public market asset positions, CIC is overweight on index and index-enhanced funds.

I have written a lot about the emerging market investment bridges between Asia and Latin America. And indeed, on the direct investment side CIC invested $300 million into BTG Pactual in 2010. BTG, of course, recently acquired Chile’s Celfin to become a regional powerhouse and to provide institutional investment capabilities to asset owners globally. I will be on a panel on global expansion opportunities with BTG in São Paulo later this month.

The second big focus globally for selected institutional investors is on Africa. Last December, CIC acquired a 25.8% shareholding in Shanduka Group for R 2 billion ($247 million), marking its foray into Africa. Shanduka Group is an investment holding company in South Africa, with businesses covering mining, finance and consumer goods. As the second biggest shareholder, CIC will leverage Shanduka to expand investments in Africa.

Lastly on the global front, CIC in mid 2011 set up the Russia-China Investment Fund with Vnesheconombank (VEB), Russia’s state development bank, and the Russia Direct Investment Fund (RDIF). CIC also launched the China Belgium Mirror Fund with Belgian Federal Holding and Investment Company (SFPI) and A Capital. In October 2011, CIC, VEB and RDIF signed a Memorandum of Understanding to establish the Russia-China Investment Fund. The Memorandum of Understanding set the fund at $4billion, with $1 billion committed by CIC and our related parties, and another $1 billion by RDIF and related parties. The fund will raise the remaining $2 billion from third-party international investors.

Also in October 2011, CIC, SFPI and A Capital signed a nonbinding letter of intent to launch the China Belgium Mirror Fund. The letter specified that SFPI and CIC will each commit €8.5 million as limited partners and cornerstone investors, with A Capital as the general partner. The fund will raise additional funds from third parties and invest in companies in Belgium and broader Europe. In April 2012, CIC’s Investment Committee officially approved CIC’s investment commitment for the fund.

In May 2011, CIC reorganized its investment departments to promote greater synergy and efficiency across departments, focusing on deeper sectorexpertise within each department. CIC engages external investment managers across all asset classes wherever appropriate.

• The Department of Asset Allocation and Strategic Research develops and adjusts strategic and tactical asset allocation plans, manages overall investment objectives and formulates alternative and passive asset investment strategies.

• The Department of Public Equity implements active strategies by using external fund managers and conducting its own proprietary trading.

• The Department of Fixed Income and Absolute Return manages all fixed- income portfolios as well as credit derivatives, hedge funds and multiasset and commodity portfolios.

• The Department of Private Equity focuses on real estate, industries, science and technology, financial services, consumer goods and services, health care and biopharmaceuticals.

• The Department of Special Investment manages and executes investments in resources, energy, infrastructure, agriculture, precious metals and other sectors with concentrated positions.

CIC’s investible capital was fully deployed in 2011. Overall, the bond and credit product portfolio outperformed stock holdings and generated relatively good returns. In 2011, CIC built up the long-term asset portfolio and weighted it toward long-term assets.

It steadily increased positions in private equity investments across various industries, especially those in emerging markets. CIC also diversified through direct or coinvestments. Here, the focus was on direct investments in oil and gas, mining and infrastructure to gear investments toward lower risk assets, such as steady return assets and resource- related assets.

The portfolio was primarily impacted by the fact that many of CIC’s private equity investments in funds or projects are still at the investment stage, along with losses of portfolio companies in energy and resources.

Notably, above we see that 57% of CIC’s portfolio is managed externally, with 80% of holdings in diversified solutions. On fixed income, corporate bonds have increased to now 21%, with absolute return solutions on the global portfolio accounting for 12%.

On risk management, CIC conducted stress tests under varied scenarios and closely monitored portfolio risks through an improved early warning system. This included a new information technology platform adopting a “classification, prioritization and modularization” management model.

All of CIC’s management activities are integrated on one information technology platform, incorporating 21 first-priority processes and 121 second-priority processes. It contains a “three lines of defense” approach, with each department as the first line of defense, responsible for hands-on and timely monitoring of its own risk and internal control processes. The Internal Control Team in the Department of Risk Management is the second line of defense, responsible for reviewing and examining internal control status across departments. The Department of Internal Audit and Department of Institutional Integrity is the third line of defense, responsible for auditing, supervising and evaluating companywide internal control management.

Looking ahead, risk management efforts are concentrated in four areas:

• Gearing the investment philosophy toward the medium and long term, based on a 10 year horizon. With no imminent pressure for short-term cash outflows, CIC wants to go beyond short-term volatility and liquidity risks to capture countercyclical investment opportunities and illiquidity premia.

• Strengthening research capabilities to build an early warning risk system, by integrating asset allocation, investment management and risk management.

• Enhancing the disciplinary and execution power of risk management and strengthening the risk management framework by enhancing execution and coverage.

• Aiming to lower the overall operational risk. To do this, CIC is promoting compliance awareness among staff, increasing interdepartmental cooperation by clarifying departmental responsibilities and integrating internal control and operational risk management functions.

Now let’s get to the meat – total assets for CIC rose to $482 billion in 2011, up from $410 billion in 2010.

Equity assets with $60 billion lead the way for financial assets, followed by alternatives at $41 billion.

Despite the ability of Asian institutional investors to keep fees at low levels, the investment expense grew from $311 million to $385 million, with overall investment income at $49 billion, down from $55 billion in 2010.

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2012