After a week without power or water, thanks to Sandy, I am about to fly over to Asia for two weeks, followed by a week in Latin America later in November.

The week here showed NY and the world how little we can do when nature decides to strike. But as after the last blackout a decade ago and 9/11, it is remarkable to see how NY reacts when disaster strikes – pushing forward stoically, helping each other and seeing the bright side.

I received dozens of texts from friends and clients in the city offering their homes, offices and hospitality while downtown was pitch black. And, interestingly, the all important meetings for the week weren’t all important after all.

The storm is estimated to cost over $50 billion, but NY is back on its feet.

Tomorrow I am off to a two week Asia tour. It has been a few months since my last trip and, given the many important product and distribution trends for HNW investors and institutions, I look forward to getting an update from clients, with a CEO luncheon this Friday hosted by Asset International’s CEO, followed by a number of speeches at conferences, for China, the region, and SWFs, among others.

SWFs especially in Asia and Latin America have been taking over, both in regard to AUM and new funds launched.

But it’s not only that SWFs and other institutional investors have accounted for the majority of investments post 2008, they are also becoming much more active – and actively involved.

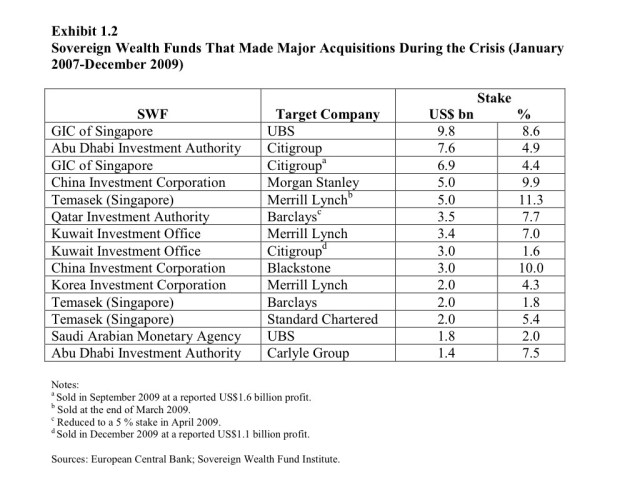

As shown above, GIC put money into UBS and Citi, CIC invested in Morgan Stanley and Blackstone, and Temasek went into Merrill. Interestingly, CIC and RDIF (Russia’s direct investment fund) this summer launched a Russia-China Investment fund as a limited partnership on a commercial basis. The fund aims to raise $2-4 billion, with $1 billion committed by CIC and its related parties, and another $1 billion by RDIF, seeking to raise an additional $1-2 billion from third-party international investors.

I will share with you updates from my discussions later in the month.

Then it’s off to Brazil and Latin America late in November, for keynote speeches and meetings with clients and institutions. With the Selic rate at 7.25% and Latin corporate bond issuance at an all time record of $70 billion so far this year, this promises to be an extraordinary trip.

Two months ago I had discussions with all major LatAm SWFs and institutional investors at a conference in NY, mostly focusing on portfolio construction and asset allocation. This time around the talks will be more around the opportunities in the current environment for the region at large.

As many of you remember, Petrobras via PifCo early in 2012 raised $7 billion for notes due in 2015 and 2017 in a single day, with demand surpassing $25 billion as a result of more than 1,600 orders placed by more than 700 investors. It was the largest ever Brazilian international bond offering and the lowest cost for a 30-year term for a Brazilian Company, with the final allocation concentrated mostly in the United States (58.4%), Europe (28.1%) and Asia.

Emerging fast-growing regions are building direct bridges fast, but for now US and European managers have competitive advantages that benefit their net cash flow picture. Still, it is not a one way street anymore and firms like Principal with over half a dozen acquisitions in the last two years in Latin America, is seeing the shifting tectonic plates.

Where is the industry going to grow? US/Europe vs Asia/Latam

I invite you to follow me on twitter @danenskat

(c) Enskat Associates 2012