As I wrote in a recent M&A update on Brazil/LatAm, Brazil takes the lead: Net cash flows, M&A, Joint Ventures and Latin America Opportunities, Latin America as a region is gaining momentum for the global asset management industry.

Specifically, we see:

– Increasing partnerships between Asia and Latin America, both from an investment and distribution perspective.

– A sustained competitive advantage for the US to expand in Latin America, including time zone proximity, brand and business models.

– Notable HNW and Ultra-HNW opportunities for NRI centers in Miami or NY, but also in Europe (Spain, Portugal, Switzerland, Lux et al).

– Strong M&A activity to get access to local clients and offshore distribution.

The anecdotal evidence is powerful and pervasive. However, without consistent and reliable data it is hard to quantify the size of the opportunity. Asset International/Strategic Insight’s teams have worked tirelessly to provide clients with access to such data, and now it is ready.

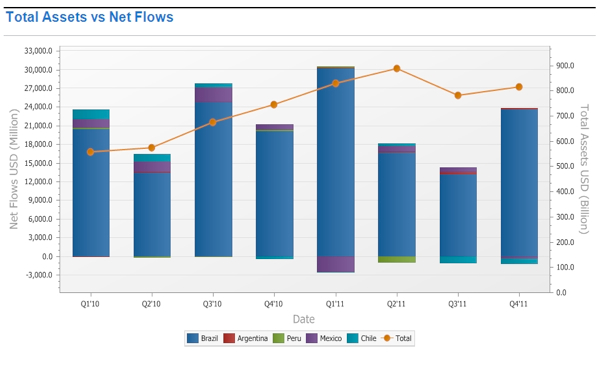

Below is a first glimpse of our Latin America database, part of the global databases offered by AI/SI.

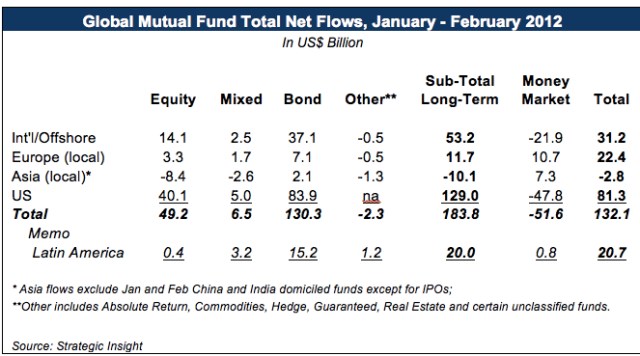

The upward momentum for the key markets we track – including Brazil, Mexico, Chile, Peru, Argentina – both from an asset and flow perspective is convincing. For the first two months of 2012, Latin America has added $20 billion in net cash contributions, mostly to fixed income vehicles, but with positive cash inflows across all asset classes. From a total global cash flow perspective, this translates into 15%.

The positive numbers from Latin America are strongly contributing to the revenues and profits for traditional US managers as well.

For example, Principal Group’s CEO Larry Zimpleman in a recent video interview with II stated that the group soon will see 25% of their earnings from outside of the US, with a focus on specifically Brazil and China. Principal a few weeks ago announced the acquisition of Claritas in Brazil to expand its existing business in Latin America.

More details can be found in my recent book, State of the Industry – Latin America, written with the help of SI analysts Lise Carpenter, Bryan Liu and Marlon Valle.

Moreover, below are thoughts from leading Brazilian firms on the industry: Interviews in Sao Paulo, Brazil, on the Latin America Asset Management Industry.

Pingback: Latin America in Asset Management – Quantifying the Opportunities for Brazil and the region « AFBic

Pingback: Asia Asset Management Trends 2012 « Daniel S. Enskat

Pingback: Learning from Chile: Principal buys AFP, the growth of Latin America retirement investing and Chile educating the US | Enskat & Associates