After the speeches in Milan (Salone del Risparmio, Bocconi University) and Stockholm (Nordic Fund Selection Forum) next week, I am finally back in Hong Kong, to meet with clients and to conduct the “Fund Forum Asia Interview – Brand vs. Boutique“, with Alan J Harden, the Asia-Pacific CEO for BNY Mellon.

Alan of course is a leader of the asset management industry in Asia. He decided to run BNY Mellon’s business in Asia Pacific after Asia CEO roles for ING, Alliance Trust and Citi.

BNY Mellon has been active in the Asia-Pacific region for five decades with 16 offices in 12 countries. We will discuss, among other things, whether there “is space for niche players in a brand-conscious market”? BNY Mellon’s AUM globally were up by 8%, to $1.26 trillion – reflecting a 130% increase in net AUM flows for 2011. The firm now has a focus on optimizing the multi-boutique model by building out investment, distribution and infrastructure capabilities, particularly in Asia Pacific. Alan will be instrumental for the firm to build out both the retail and institutional business.

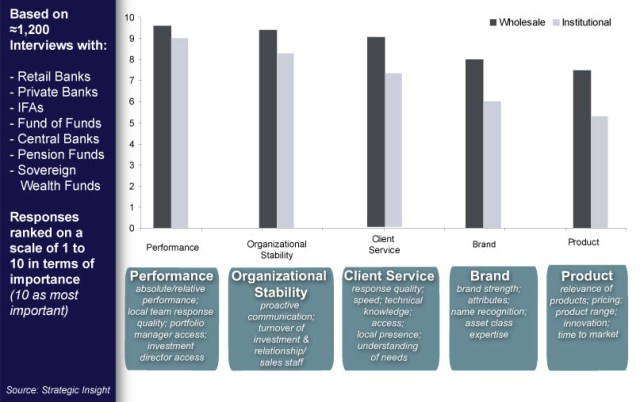

Based on Asset International/Strategic Insight proprietary research and surveys with asset holders in Asia-Pacific and worldwide, brand post-crisis has become a key decision criterion for them to choose managers and investment products. As discussed in my 2011 book on manager and fund selection processes of global asset holders post-crisis, the right mix of investment performance, brand, service and organizational stability has enabled blockbuster firms to collect $1 trillion in net cash flows each year from 2009 through 2011.

Top cash flow firms that benefited from a powerful brand with institutional and wholesale clients in 2011 included large and small firms, including Blackrock, PIMCO, Franklin Templeton, Investec, Value Partners, Schroders, and others. Please review David & Goliath in Asset Management … Star vs. Team Approach for details.

Last year I had the pleasure of interviewing Dr. Michael Hasenstab on the success of Franklin Templeton’s global bond fund and the business overall.

One differentiating factor for the firm has been the use of global campaigns around key investment themes, e.g. “2020 Vision for Equities”, “Global is the new core”, “the case for yields”, and most recently, a global investor sentiment survey. Investec on its website features a concise video overview of the firm’s key investment themes and senior managers, narrated by its CEO, Hendrik du Toit. PIMCO of course with Bill Gross and Mohamed El-Erian has changed the way the industry speaks, with its “new normal”.

For a few more details on specific firms, please review Content, speed AND style of the message: The Secrets of Success for Franklin Templeton and Pimco/Allianz.

Of course, my 2011 book on “The Seven Secrets of Distribution” also features many case studies for specific firms, and specifically examines the importance of brand – here is a webcast and exexcutive summary of the book.

All of this should make for a fascinating exchange with Alan in Hong Kong later this month. Please send me your questions ahead of time and we will include them.

#NewNormalofBrandinAssetManagement.

You must be logged in to post a comment.