It all started in 1997… that’s when Deutsche Bank and the Solomon R. Guggenheim Foundation opened “Deutsche Guggenheim” in Berlin, to feature modern and contemporary art.

Solomon Robert, of course, one of Meyer Guggenheim’s ten children, founded the foundation in 1937 and today, in addition to the one in Berlin, it administers the Guggenheim museum in NY, the Guggenheim museum in Bilbao, and the Peggy Guggenheim Collection in Venice.

2012 will mark the end of this partnership – the contract ends this year and both parties in early February announced that the museum in Berlin will close.

As one “Deutsche Guggenheim” is closing, another one is opening.

In late February 2012, Deutsche Bank announced that it is entering exclusive negotiations with NY-based private equity giant Guggenheim Partners (GP) to sell some $550 billion in AUM from its asset management business; specifically, DWS Americas, the US mutual fund arm, DB Advisors, the institutional and insurance business as well as the real estate operations (RREEF). The deal is valued in the vicinity of $3 billion.

Guggenheim Partners, of course, was founded twelve years ago by Peter Lawson-Johnson Sr, a great grandson of Meyer Guggenheim. The firm is led by Mark Walter (CEO), Todd Boehly (President, former CSFB), Alan Schwartz (Executive Chairman, former Bear Stearns CEO), and Scott Minerd (CIO, former CSFB).

The deal is noteworthy for a number of reasons, and also highlights metatrends pointed out in our research in recent years.

1. The appeal of asset management & industry consolidation:

The financial services industry has suffered from numerous scandals since 2008 (Madoff, Lehman, rogue traders, et al). As a result, market uncertainties and investor anxieties have led to a trend back-to-basics, and mutual funds and asset management have moved from foster child to prodigal son (or daughter). Low capital requirements, blockbuster cash flows and sustainability of assets furthermore accelerated consolidation in the industry, as some larger groups had to sell their asset management businesses away from their ‘core’ interests or to strengthen the balance sheet (Deutsche, Santander, et al), while others are strategically investing to build investment capabilities and distribution hubs (CSHG, Aberdeen, Safra, et al), often involving emerging markets.

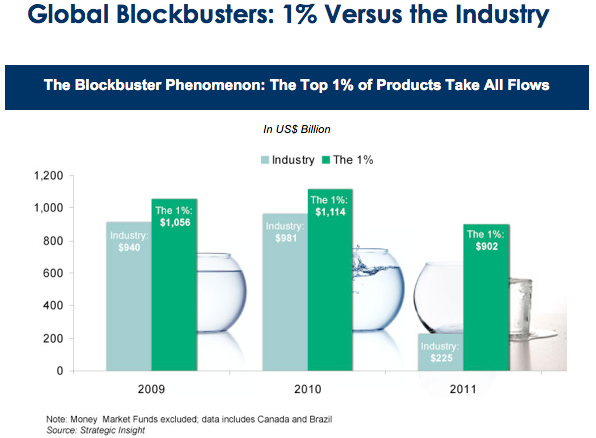

The top 1% of products worldwide in the last three years collectively gathered $3 trillion in new cash contributions (as discussed in my recent book on the State of the Asset Management Industry – March 2012). Building a strong brand and a global blockbuster product can change the game for any company.

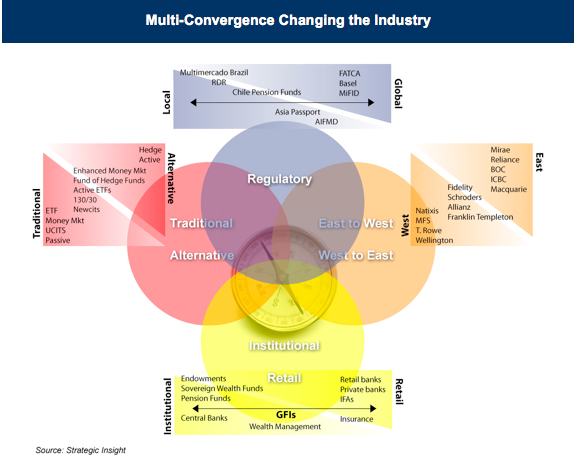

2. Multi-convergence in the asset management industry:

We have seen blurry lines of demarcation between the retail and institutional businesses since the crisis, especially inasmuch as brand is concerned. For instance, PIMCO generated institutional business using Bill Gross‘ retail brand, and now is trying to re-engineer the brand around institutional and risk processes while building a retail presence after leaving the Allianz network. Global financial institutions worldwide are using institutional methodologies and selection criteria while ultimately selling solutions to mass affluent and retail networks (e.g. high yield in Japan, or Asia themes by US managers in Chile). GP has significant expertise on the institutional side of the business, and with an acquisition could add $550 billion in assets under management to instantly become a “Goliath brand” and strategic partner for GFIs and others.

More than 30 parties were interested in those assets, but GP prevailed. The deal, which could go through in the first quarter of 2012, would give GP its first presence on the ground in Australia. Going global.

3. The Globalization of the investment management industry and West-to-East vs. East-to-West:

Guggenheim Partners of late has focused on becoming more competitive globally, as borders for the industry are becoming less relevant and blockbusters are created worldwide. In mid-March 2012, Henry Silverman, the former chief operating officer of Apollo Global Management, will join GP to advise on expansion as vice chairman of investment management based in New York.

Guggenheim Capital LLC, the majority owner of Guggenheim Partners, has raised money from outside investors, including Sammons Enterprises, a Texas-based company with diversified investment interests.

Last summer, Singapore’s K1 invested $100 million in preferred units and some 11 million detachable warrants to acquire common units in Guggenheim Capital LLC, for GP to expand globally. The preferred units deliver a 7% annual dividend and are senior to all common equity. One of the largest acquisitions for the firm, K1 foresees complementary benefits including co-investment, strategic JVs, and access to capital.

K1’s chairman and CEO, of course, is Steven Jay Green, former US ambassador to Singapore and founder of PE firms Greenstreet Partners and Greenstreet Real Estate Partners. As part of the deal, Green will become member of Guggenheim’s executive committee. K1 had a 2011 EBITDA of close to 40 million on some $75 million in revenues. The management team includes Choo Chiau Beng, non-resident ambassador to Brazil (another M&A hotspot), Yong Pung Ho, Singapore’s former chief justice, and Jeffrey Alan Safchik.

As we have seen in recent months, the M&A scene is heating up worldwide. Whether it is Sao Paulo-based Safra buying Swiss Sarasin to build Europe, Middle East, and Asia HNW distribution, Aberdeen buying Nationwide in the US, Credit Suisse buying Hedging Griffo, or Principal buying Claritas, the importance to build a global network to leverage investment and distribution capabilities in an age of blockbusters and multi-convergence will be paramount.

Guggenheim definitely has the brand equity and people to build a Goliath firm. Scott Minerd in his recent market perspectives has focused on “winning the war in Europe” (GP is an advisor to Greece), and “the triumph of optimism”.

Welcome to 2012, go hard or go home.

Pingback: Multi-Convergence – Products: Alternatives vs Traditional « Daniel S. Enskat