China is becoming the center of attention for the world.

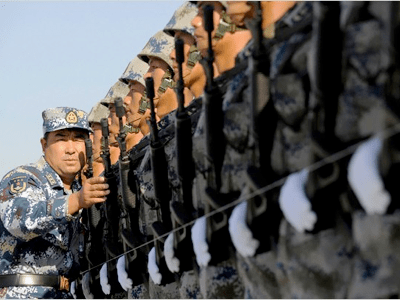

Ahead of tomorrow’s 60th anniversary celebrations of the Communist party China again demonstrates its attention to detail, as shown by the army instructor in the picture above (Source: NY Times/. According to the NY Times, “soldiers have practiced endless hours to hold their rifles at precisely the same level. Photos show their instructors holding threads as rifle guides, or sticking needles in soldiers’ shirt collars, pointed at their necks, to correct poor posture.”

The whole world remembers the Olympic Games 2008 Opening Ceremony in Beijing, in particular the visual and musical countdown of the 2008 drummers in the stadium.

Leaving questionable and negative aspects of the planning aside, the preparation, precision and execution of the whole event, showcased China’s management expertise, willpower and ambition – alongside its growing global influence.

-HSBC this week moved its CEO to Hong Kong from London, acknowledging “Asia and China are the centre of gravity of the world and our business”.

-The G20 officially replaced the G7, mostly to make room for the growing role of China (and Brazil).

-Robert Zoellick, current president of the World Bank in a Johns Hopkins University lecture pointed towards the Chinese Renminbi and the Euro as alternatives to the US dollar (the World Bank forecasts 7.2% GDP growth for China this year).

-Japan is relying more on China than the US and Europe to reduce the Yen’s exposure to currency swings against the Euro and Dollar.

-Goldman Sachs raised its China GDP forecast to 8.3% for 2009 and 13.5% for 2010.

-“As the world’s economic center of gravity shifts to Asia, U.S. preeminence will inevitably diminish”, wrote Jeff Sachs in 2004.

-Capgemini/Merrill Lynch in its annual HNW survey found that the number of HNW investors in China this year surpassed the UK and is now the fourth largest in the world (behind the US, Japan and Germany).

-Dechert’s Financial Services group in a September 2009 legal update stated that such GDP growth is resulting in a Chinese middle class of 300 million people, with $3.3 trillion in household savings.

-PWC estimates a doubling of investors by 2012, to almost 70 million retail investors and 2,500 institutional investors.

-Porsche unveiled its grand tourer Panamera at the Shanghai Auto Show. Porsche changed the design to allow for more room in the back for Chinese executives, who like to use a chauffeur (since many of the rural entrepreneurs don’t know how to drive). China has surpassed the U.S. as the world’s largest auto market.

-Thomas Friedman in recent blogs has highlighted that in his view “future historians may well conclude that the most important thing to happen in the last 18 months was that Red China decided to become Green China.” Energy technology, or E.T., as Friedman calls it, will be as big as I.T. and driving force of business by 2050 and China intends to be a big E.T. player.

-Asia domiciled funds thus far in 2009 collected $60 billion through July, according to our database Simfund Global. China featured prominently, with a CSI 300 Index launch by China AMC attracting $3.6 billion in three days in July! China Universal gathered $1.3 billion into a Shanghai Composite Index fund.

When I visited Beijing and China extensively in 2008, several things stood out in meetings with regulators, companies and industry observers:

-Beijing vs. Shanghai: Just as in the US (NY vs. L.A.), Switzerland (Zurich vs. Geneva) or Asia offshore (Hong Kong vs. Singapore), there are important cultural and business management differences. The CSRC in Beijing drives the fund management industry, while Shanghai is the international avant-garde melting pot.

-Relationships are more important than in Europe and the US, not unlike other emerging markets such as Latin America or the Middle East – Round the World tickets and a few visits a year are not enough (see HSBC above).

-Fund flows of almost $200 billion in 2007 did not blow up during the crisis. Quite the contrary, bankers are hailed as “model workers” and after resilience in 2008 net cash flows are rising again.

-International fund managers need to make a strategic long-term commitment to China if they want to be successful, independent of whether via a JV, QDII, or dealing with the CIC.

-The highly trained Chinese parts of the existing JVs have taken advantage of their international counterparts expertise and are keen to broaden their business horizon beyond the domestic market (soon).

-Rebuild and improve: One should not be surprised by the stamina and ambition of China. The breathtaking buildings in the Forbidden City regularly were destroyed by fire, yet instead of despairing in front of the ashes, China each time got back to work, rebuilt its glory and used it as an opportunity to raise the bar higher.

-When you go to art.com, you can order a Picasso print and frame it or you can have it hand painted in China on oil and shipped to you – for 30% less.

Happy Anniversary.

You must be logged in to post a comment.